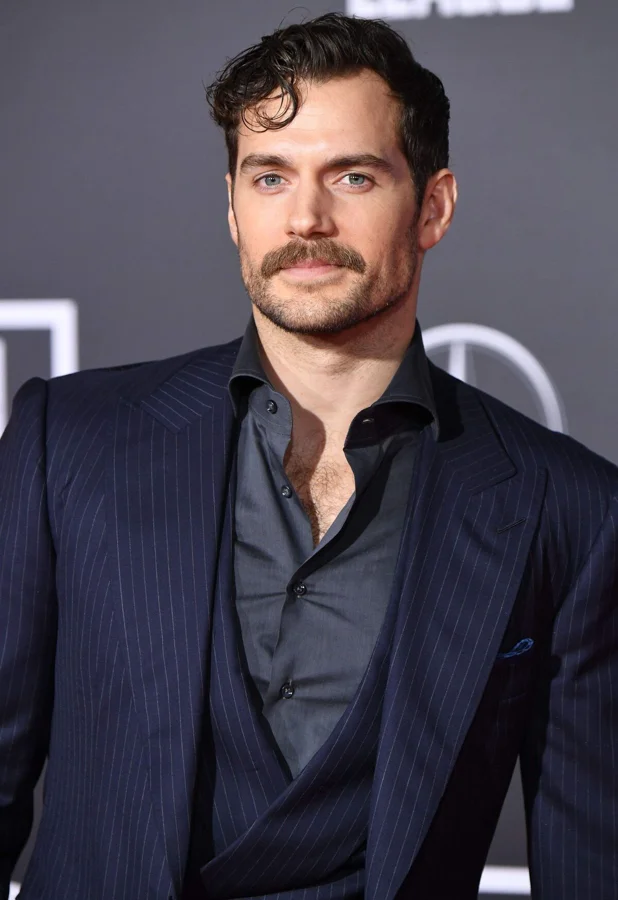

A recent post by Netflix France highlighting Henry Cavill’s return as Superman in the post-credit scene of Black Adam has reignited fan hopes for a comeback, especially in light of Warner Bros. Discovery’s (WBD) potential sale. Since the controversial Justice League release in 2017, Henry Cavill’s portrayal of Superman has been sidelined, but this resurgence comes amid reports that major companies like Netflix, Paramount Skydance, and Comcast are interested in acquiring WBD, the parent company of DC Studios.

Henry Cavill’s Superman faced a long hiatus after the mixed reception of Justice League, which underwent significant changes when Zack Snyder, the original director, was replaced by Joss Whedon. Despite the eventual release of the Snyder Cut in 2021, Cavill did not film additional scenes for that version. It was not until September 2022, shortly before Black Adam premiered, that Dwayne “The Rock” Johnson persuaded Cavill to return for a surprise post-credit appearance teasing a battle between Black Adam and Superman. However, these plans were later scrapped when James Gunn took over DC Universe (DCU) creative direction and announced David Corenswet as the new Superman.

The Netflix France social media post, sharing images of Cavill’s Superman alongside Johnson’s Black Adam and asking “1 vs 1, who wins?”, has fueled online discussions and fan campaigns such as #RestoreTheSnyderVerse, which advocate for Cavill’s return and the continuation of Zack Snyder’s vision for the DCEU. Meanwhile, the ongoing discourse about WBD’s prospective sale has added complexity to the future direction of DC Studios and its characters.

Reports indicate that Paramount Skydance appears to have made the only formal bid for WBD so far, but the offer of $20 per share was rejected as too low. WBD has officially acknowledged receiving unsolicited acquisition interest from several parties, with its board of directors actively reviewing strategic options to maximize shareholder value. This development highlights the possible transition of one of Hollywood’s largest entertainment companies, but details about how such changes would affect DC’s cinematic universe remain uncertain.

The speculation about a Netflix acquisition has galvanized fans who wish to see the SnyderVerse rebooted under the streaming giant’s umbrella, a concept expressed through hashtags like #SellSnyderVerseToNetflix circulating on social media. Just days before Netflix’s recent post, Zack Snyder reinforced this sentiment by sharing a behind-the-scenes photo from Batman v Superman, accompanied by the statement, “Henry Cavill is Superman.”

What a Warner Bros. Discovery Sale Might Mean for the DCEU

Although WBD’s exploration of a sale signals potential upheaval, any acquisition deal is likely to be drawn-out, making immediate changes at DC Studios improbable. The Netflix tribute to Henry Cavill’s Superman may raise hopes for restoring Snyder’s narrative, yet it probably was a marketing move aimed at capitalizing on Cavill’s popularity rather than signaling official plans from decision-makers within Netflix or other interested bidders.

Much of DC Studios’ future direction depends on the success of James Gunn’s rebooted DCU. New ownership would likely hesitate to disrupt a franchise managed by an experienced filmmaker if it is performing well. The current DCU slate, featuring new actors and stories, represents the studio’s ongoing attempt to reboot and stabilize its superhero offerings after previous missteps.

Meanwhile, Zack Snyder has been closely involved with Netflix projects such as Army of the Dead and Rebel Moon, though sequels for these franchises do not appear imminent. Snyder has recently shifted focus toward other film genres, including the war drama The Last Photograph and a UFC-themed movie titled Brawler, indicating that his time with superhero storytelling is winding down.

The unfolding WBD sale and associated fan excitement underscore the broader uncertainty surrounding the DCEU’s future. Fans of Henry Cavill’s Superman eagerly watch for any signs of revival, but the complexities of corporate acquisitions and ongoing creative shifts mean that any definitive return remains hopeful rather than assured.